We mark our life by key milestones – we graduate college, get a “real” job, marry, buy a house, have kids, care for our parents, and retire. Not necessarily in that order. In fact, the age we hit these milestones (or don’t) can differ quite substantially.

My arc looks similar to my wife’s, somewhat different from my friends from high school, and almost nothing like my parents or what I anticipate for my kids.

Each generation seems to have its own expectations for when they should and do mark these milestones. As the father of two Millennials, I find it interesting and not at all surprising that Millennials think they should do more things now, but be able to get a real job later versus other generations. To quote my youngest daughter “That’s a shocker”.

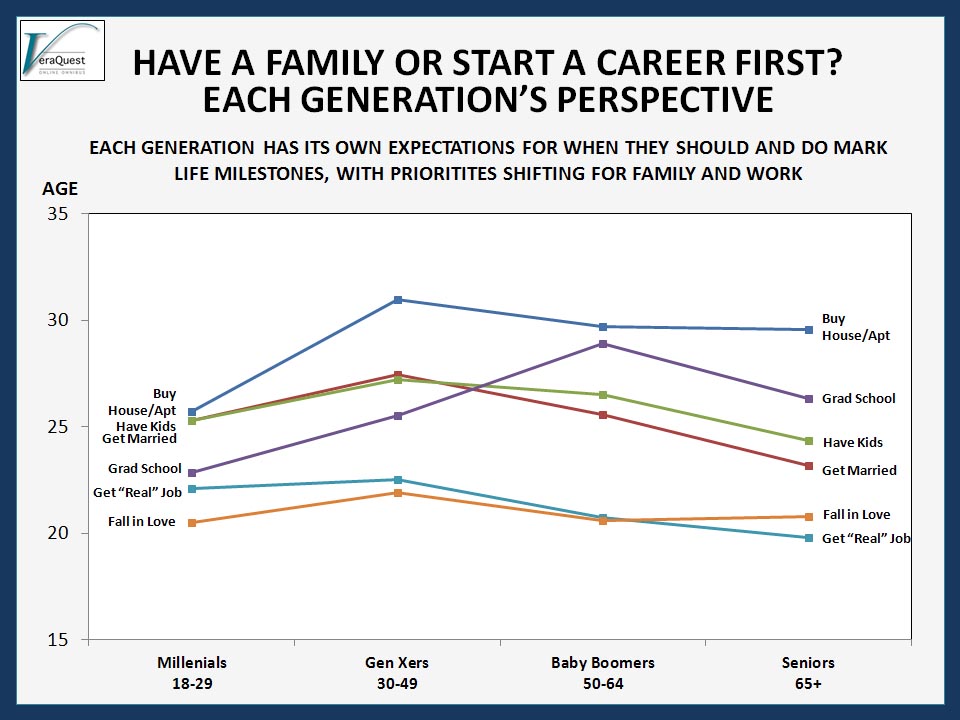

In any event, priorities shift for family and work as follows:

Each Generation’s Perspective

- For Millennials (18-29 year olds), most of whom are looking forward, anticipate: Falling in love around age 21; getting a “real” job or going to graduate school at age 22; marrying and having kids a few years later around age 25; buying a house the same year; starting to care for parents about 10 -15 years later around age 38; and retiring at age 60.

- For Gen Xers (ages 30-49), they may fall in love around age 22, same as the Millennials, but they kick off both their career and any extra education in their low to mid 20s, well prior to getting married and having kids. And they start their family about 3 years later than their Millennial counterparts. They also don’t start caring for their parents until their 40s.

- For Baby Boomers (ages 50-64), the first time they fall in love still occurs in their low 20s. However, their family vs. work trajectory follows a reverse path to the Gen Xers – starting their family first (in their mid 20s) and then getting a “real” job, going to graduate school, pursuing their career, and buying a house in their late 20s and early 30s. As with everyone else, they plan to retire around age 60 but start caring for their parents later, (on average) around age 50.

- For Seniors ages 65+, on average, marriage and children happens a little earlier than the generations prior and caring for their parents occurs later (around age 51). However, they look more like the Baby Boomers, with respect to taking time to save money and buy a house (around age 30).

Has the marriage pendulum swung in one direction and now back? What is your interpretation of the data showing Millennials following a more similar path to their senior grandparents rather than their parents? Why does the time when adults plan to or start caring for their own parents seem to keep dropping lower and lower?

Note – Results among those expecting to experience each life event

Leave a Reply