Cyber attacks. Ok, let’s see…off the top of my head I can think of the recent credit card data breaches at both Target and Michael’s, as well as the customer data breaches at Home Depot, AOL, eBay and Anthem. Hackers had access to the information within JPMorgan’s customer accounts for a couple months (yikes). Oh, and of course, who can forget the big Sony corporate hacking? There have been a lot of cybersecurity and identity theft victims this past year – big corporations were victims, as were their customers.

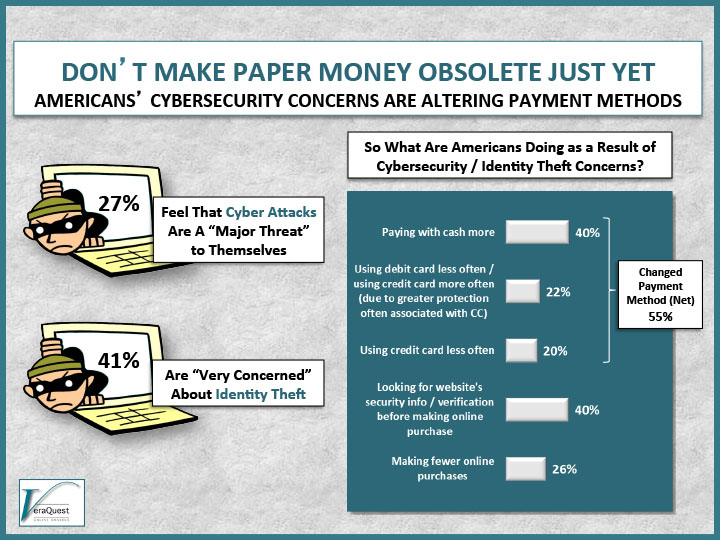

We asked 1,500 U.S. adults on a recent VeraQuest omnibus survey how safe they feel, given all the hackings and data breaches over the past year or so. And while most Americans feel that cyber attacks are a “major threat” to the United States overall (66%) and to U.S. companies/retailers (66%)… interestingly, only about one-quarter (27%) feel that cyber attacks are a “major threat” to themselves, personally.

Personal identity theft – which can certainly result from a cyber attack – hits a bit closer to home, however. While nearly all Americans have at least some level of concern about identity theft, a sizeable number (41%) say that they are, in fact, “very concerned” about it.

In terms of specific personal information or online content Americans are concerned about… The majority of Americans (57%) feel that content stored in the cloud is “unsafe”. Half (50%) feel that credit card information is unsafe when used for an online purchase, while slightly fewer (44%) feel that credit card information is unsafe when used in-person, at a retailer. About the same amount (45%) feel that personal email addresses, contact lists, and email content are unsafe. Two-in-five (40%) do not feel that their personal passwords are safe.

What I find particularly interesting is what Americans say they are doing differently, as a result of cyber security and/or identity theft concerns. As a direct result of these concerns, over half of Americans (55%) say they have changed their payment methods in some way. About one-in-five Americans (22%) say they are using their debit card less often and instead using their credit card more often (due to the greater protection offered by most credit cards). Furthermore, just when there is an abundance of electronic payment systems, including smartphone payment apps and the like, 40% of Americans say that they are paying with cash more often now, in order to try to limit their chances of being a victim of hackings and identity theft. And guess what group is leading this charge? It’s the tech-savvy Millennials (a surprising 47% of adults 18-34 say they are paying with cash more as a direct result of cybersecurity/ID theft concerns, compared to 37% of adults 35+ years of age who say they are doing the same). If they are choosing to pay with cash more often, then I think the rest of us better take heed.

While there appears to be no let-up in online sales growth, we can’t help but wonder whether cybersecurity threats will begin to have an impact in the near future. While 40% say they are being more vigilant about reviewing a website’s security information before making an online purchase, about one-quarter of Americans (26%) say they are simply making fewer online purchases as a result of cybersecurity/identity theft concerns.

It’s interesting. We take such big leaps forward with all the technology advances in this day and age…only to fall back to using cash to make our purchases.

Do you think the government should require companies to take certain cybersecurity measures, to ensure the safety of their customers’ personal/financial information? Are you confident that technologists even know how to completely protect online information from hackers?

Leave a Reply