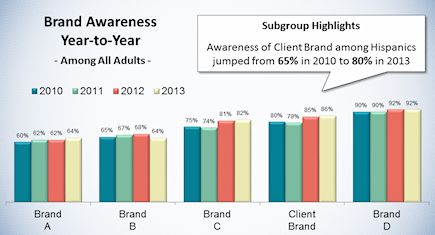

The purpose of any marketing program whether it be advertising, promotion, event sponsorship or social media campaigns is to effect change – changes in awareness, attitudes and ultimately buying behavior. Therefore, monitoring these changes over time is critical for determining the degree to which a given campaign is effective. Syndicated store scanning data is the gold standard for measuring changes in buying behavior, but survey data is necessary for measuring changes in attitudes and awareness. The “why” behind the “buy”.

That said, it’s imperative to know that any observed changes in awareness, attitudes, or behaviors seen in a tracking study reflect real changes in the marketplace versus changes manifested due to inconsistently defined sample. To that end, the sampling plan is an important consideration when undertaking a tracking study, or pre/post snapshot studies. At VeraQuest, we employ one of the most stringent sampling plans in the industry by requiring quotas for six dimensions (e.g., age, gender, region, income, education and ethnicity).

Tracking studies often tend to be expensive propositions. An omnibus survey is an often overlooked, yet cost-effective alternative for conducting tracking studies, particularly when you’re only interested in capturing a half-dozen to a dozen key metrics, such as aided and unaided awareness, purchase and usage frequency, message recall/ad recognition, brand image, and key brand equity/affinity measurements. VeraQuest also provides a PowerPoint report with each wave putting your trended information in an easily accessible, understandable and management-ready format. Just because Tracking Studies are a valuable tool, they shouldn’t have to cost an arm and a leg.