Like most of the American public, my family and I have been the target of financial fraud. My daughter’s ATM card was compromised. There was an attempt to buy airline tickets on Southwest and United Airlines on my credit card, but somehow the airlines figured it out before I did and credited my account before I noticed. The same guy (or gal) finally did succeed buying flowers…a crook with a softer side I suppose. We have friends whose parents wired cash to their “grandson” in legal trouble in Costa Rica, except he was actually safe and sound in N.J. And we all have been approached by a stranger needing help to access a large sum of money from a Nigerian government official.

However, according to trends reported by the U.S. government, I am one of the lucky ones because in all of these cases, my identity was never stolen. In 2010, about 8 million people were actually the victims of identity fraud, costing the country $37 billion.

In a case of good news/bad news, it is notable both how easy it appears to be to gain access to someone else’s information and forge a new identity; yet how many millions of transactions take place online every day without anything going wrong.

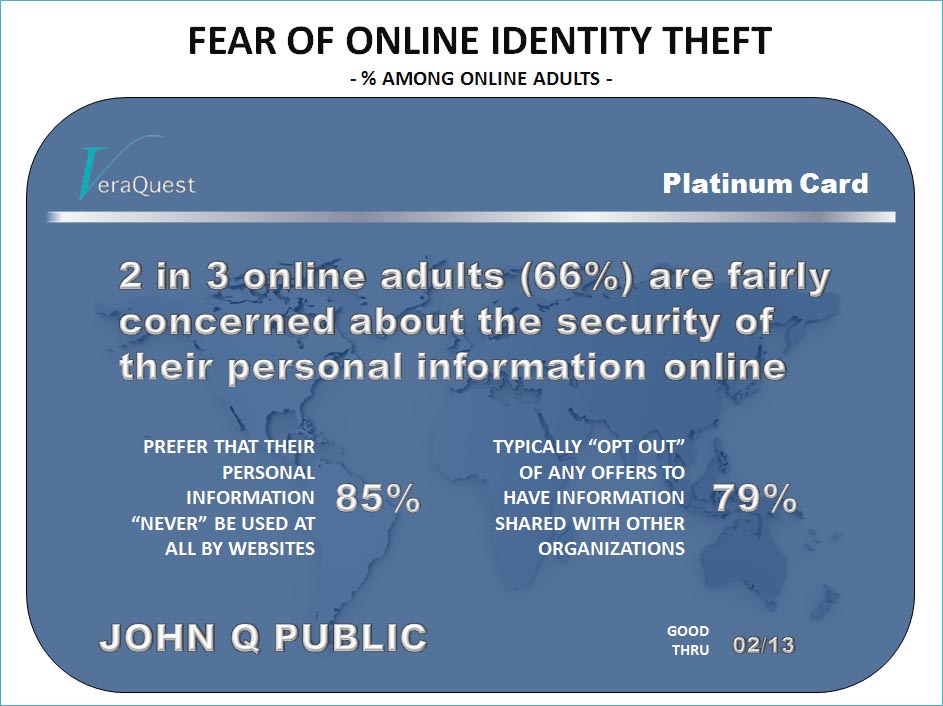

But how much identity theft is too much and when should the government get involved? A recent VeraQuest omnibus survey shows that approximately 2 in 3 online adults (66%) are fairly concerned about the security of their personal information online.

And even when personal information is used for the “good” to provide customized (and presumably appealing) products, services or discounts, the majority of online adults are not interested:

Nearly half (47%) of online adults feel this issue has become so serious and pressing that the federal government needs to get involved and start drafting some legislation that offers consumers some protections. No longer do these privacy stalwarts feel that websites can effectively self-regulate.

But it’s not crystal clear how the government should move forward here (especially if they are taking direction from the public) because while nearly half of the public (47%) wishes the government would get involved, a fairly similar but slightly higher percentage (53%) believes that websites should be able to store and protect consumer information without any government intervention.

How do you feel when you surf the Web? Do you worry that your personal information will be compromised – or do you surf around freely and comfortably? Do you feel the government has some responsibility to get involved – or that websites should be able to control this issue on their own?

Elizabeth Abbas says

Elizabeth Abbas says

March 6, 2013 at 8:29 amThis is one thing I mostly feel like not thinking about. Because once I start thinking about it…it just makes me worry, and I really don’t want to worry about all the things I do online. I opt-out of extra mailings, etc, but I am one of the ones who would rather have ads that have some sort of relationship to who I am than any old random ad campaign. But when it comes to identity theft, that’s pretty scary. So…I choose to just not think about it, because I’m not going to stop using the internet for my shopping, etc…and I don’t want to do all the things the experts say we should do to protect ourselves..re changing passwords, etc. So..I think I’ll just put my head in the sand and keep my fingers crossed, and probably be really sorry I did those things if something bad happens 🙁 I do think that regulation can sometimes help, but not sure what kind would work for something like this!